The Basics of Stock Portfolio Diversification

You only need 8 to 12 stocks to reach diversification

| Written by Tom Yeung, CFA | CDFA Investment Advisor & Fund Manager, Jurnex Financial Advisors |

Summary: in this article, we explore what a portfolio diversification looks like and find that optimal stock investing only requires 8 to 12 stocks. We also look at alternatives if you can’t find 8-12 great investments.

There are many things that investors can do to protect their wealth. Portfolio diversification ranks among the top things you can do. But what does a diversified portfolio look like?

Certainly, owning different companies in different industries can help reduce risk. But many mutual funds have taken the concept of diversification to extremes. The average mutual fund holds 90 companies. No wonder mutual funds underperform as a group! And broad-based ETFs (while very cheap!) also have problems with diversification.

On the other hand, putting all your eggs in one basket leaves you vulnerable to specific risks at a company.

In this article, we will cover what a well-diversified portfolio looks like. How many stocks do you need? And how can you avoid the trap of owning too many low-quality stocks?

What does portfolio diversification look like?

Before we look at how exactly to diversify your portfolio, we should define what portfolio diversification actually looks like.

1. Diversification means reducing company-specific risk

Things can happen with individual investments. Product lines can fail, or consumer preferences can change. Diversification means spreading out your investments enough so that any particular event (whether fast or slow-moving) to hit one investment won’t cause uncontrollable loss to your overall portfolio.

2. There are certain risks that cannot be diversified away

A diversified portfolio may still carry certain risks.

Market risk: according to the Capital Asset Pricing Model, market risk cannot be completely removed by diversification. No matter how many companies you own, a stock market crash still cause your entire portfolio to decline.

Underperformance risk: only half of all companies are above average. Owning too many companies often means investing in subpar companies as well, a process known as “diworsification”

3. Diversification only requires 8-12 stocks

For the average individual investor, investing in 8 to 12 stocks turns out to be ideal.

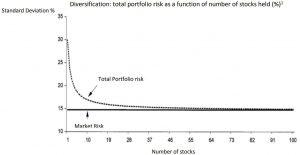

Diversification actually happens much faster than people expect. According to a study by Dresdner Kleinwort, owning 8 stocks removes 83% of all diversifiable risk. Owning 12 removes 87%.

Portfolio diversification only requires 8-12 stocks to reach 80-90% of possible diversification.

While owning 100 or more stocks can add even more diversification, the costs very quickly outweigh the benefits.

- Sheer overwork can be an issue. It’s almost impossible for an individual investor to keep track of 100 companies, let alone 20.

- Trading costs also become a major issue. Even if your brokerage firm only charges $5.95 per trade, rebalancing a 100-stock portfolio suddenly costs $595 each time.

On the other hand, owning just 8 to 12 stocks in different industries creates an optimal balance between having few enough companies or a part-time investor to oversee, while having enough diversification that no single company can ruin your portfolio.

4. Diversification requires each investment have different “levers”

Selecting 8 to 12 random stocks doesn’t mean you have a diversified portfolio. You need to find stocks that are affected by different factors, also known as “levers”.

For example, oil and gas companies often move together, since energy prices are closely related.

On the other hand, many companies often move in opposite directions. Banks and utility companies are an excellent example. A rise in interest rates will help banks because they’ll earn higher interest income. A drop in interest rates, on the other hand, benefits utility companies since they can refinance debts at lower rates.

A well-diversified portfolio should seek to incorporate these kinds of levers. If you own an oil producer, you might want to consider also owning a company that benefits from lower oil prices, such as transportation companies or manufacturers. That way, you can protect yourself from an unexpected fall in energy prices.

5. Regular ETFs provide some diversification but come with downsides

It’s become popular to invest in broad-market ETFs that track the S&P 500. While this provides a great deal of diversification, it also comes with certain downsides:

- Favors large-cap companies. Since the S&P 500 weighs companies based on market cap, you will have a larger exposure to large-cap companies such as Apple and Google.

- Favors overvalued sectors. Technology is overrepresented in the S&P 500 due to its higher valuations

- Naive diversification. Broad-market indexes invest without regard to whether each investment has different “levers”. A single investigation into tech monopolies, for example, may target 3-4 or the top-5 S&P 500 companies.

Why you only need 8-12 stocks for diversification

So now we know what a diversified portfolio looks like, let’s explore why diversifying into an 8-12 stock portfolio is far superior to trying to add 50-100 names.

1. Allows you to keep track of investments

We all have limited time in our lives, and each company takes time to analyze and track. Even full-time stock analysts only cover only 40-50 companies at a time. (And they often work in just a single industry!)

For the average investor, keeping track of 8 to 12 companies is far more ideal. It allows you to keep watch of your investments while still maintaining the benefits of diversification.

Companies also take time and effort to monitor. Highly technical businesses like biotech can even take several days or weeks to truly comprehend. And companies in fast-moving industries often have new developments several times a month.

Yet these fast-moving businesses often offer phenomenal returns. Investors in older tech companies such as Sun Microsystems or Intel would have seen their investments return >100x times. Amazon would have returned >1000x for early investors.

But these businesses were new and complex in their early days, requiring additional time and effort to truly understand. Having just 8-12 investments gives you the time to do the right analysis.

2. Allows you to wait for great investments

As Warren Buffet says: you don’t have to swing at every pitch.

“The trick in investing is just to sit there and watch pitch after pitch go by and wait for the one right in your sweet spot. And if people are yelling, ‘Swing, you bum!,’ ignore them.”

That’s because there is no penalty for watching an investment go by. The only way to strike out in investing is to make the wrong investments

Having just 8-12 companies in your portfolio allows you to wait for great investments. You don’t have to be an expert in every company. The size of your expertise doesn’t have to be large. You just have to know its boundaries.

3. Removes companies you don’t agree with

The problem with investing in index funds is that you can end up funding many companies that you disagree with. These may include:

- Addictive substances: tobacco, alcohol, opioid medications

- Environmental/ethical: oil, chemicals, livestock, private prisons

- Corporate social responsibility: women, LGBT, minorities

To justify some of their holdings, some investors are capable of high-flying mental gymnastics that would make many Olympic teams blush. Some investors may intensely dislike the way tobacco companies market themselves, or how private prisons are run. Yet investors who hold index funds are incapable of voting with their feet. That’s because broad-market index funds invest in virtually EVERYTHING.

When you own just 8 to 12 companies, you become able to pick and choose the companies policies you agree with.

4. Better long-term outcome

Many studies have shown that smaller funds will perform large ones. That’s because more funds are willing close to new investor funds that have grown too large. (source)

By channeling your portfolio into only the best investments, you will have an easier time generating good long term outcomes.

As Charlie Munger once wrote about his business partner, Warren Buffett:

“I could improve your ultimate financial welfare by giving you a ticket with only 20 slots in it so that you had 20 punches—representing all the investments that you got to make in a lifetime. And once you’d punched through the card, you couldn’t make any more investments at all. Under those rules, you’d really think carefully about what you did and you’d be forced to load up on what you’d really thought about. So you’d do so much better.”

Winners have to bet selectively. That’s because the better investments you make, the better your long-term outcome will be.

What if you can’t find 8 to 12 companies to invest in?

A well-diversified portfolio can also hold smart beta ETF’s.

Rather than invest in a subpar company, or your money as cash, it can be advantageous to park your money in what are known as smart beta ETF’s.

What are smart beta ETFs?

Smart Beta ETFs are funds that track factor-based indexes. These are indexes look at additional company factors when determining it’s weight in an index. Metrics can include factors such as quality, growth, corporate governance and value.

On the other hand, regular ETFs generally invest in companies based only on size. Large companies get higher weights, regardless of their quality.

Are smart beta ETFs safe?

Generally, yes. Smart beta ETFs have the same risk factors as other ETFs, and so they can still go down in value. However, they also have the same benefits as regular ETFs and more. Like regular ETFs, they can help investors spread risk across hundreds of different companies. In addition, smart beta ETFs follow time-tested rules that favor companies with stronger fundamentals, better growth, and cheaper share prices. This can hlep you create a well-diversified portfolio for the times you can’t find 8 to 12 great investments in individual companies.

How to add portfolio diversification to your investments?

If this sounds like a lot of information to go through, don’t worry. The good news is that you don’t have to do it alone.

Great asset managers can help you understand and make investments. Regardless of your level of experience, finding help or advice can help improve your long-term investing skills.

Where to find more resources

If you’re looking to revamp your stock portfolio, there’s no better time than now. All it takes is a phone call.

That’s because I’ve invested client money for over a decade in the same old-fashioned way: seek out great companies in good industries, that can be purchased at a discount to their fair value. Sounds too simple to be true? Give me a call today and I’ll show you that it’s still possible after all these years.

About Jurnex

At Jurnex, we have the securities backing of Charles Schwab. Yet we retain our operational independence from any third party. This means you can have the confidence your money is safe with one of America’s best brokerages and still receive knowledge and advice from an independent firm focused on YOU.

Want to learn more?