Long Term Care Planning

The financial guide to funding and planning long term care

| Written by Tom Yeung, CFA | CDFA Investment Advisor & Fund Manager, Jurnex Financial Advisors |

In this article, we cover the financial aspects of long term care planning.

The cost of long-term care has skyrocketed over the past decades, making it difficult for even well-seasoned investors to plan. According to Genworth, an insurance company, the average cost of nursing home care in the US now stands at a staggering $102,204 per year. And prices are expected to keep rising. At estimated trends, a 55-year-old can expect to pay $300,000 per year when he or she reaches age 85.

And if you’re worried about long term care planning, you’re not alone. According to Personal Capital, even the affluent worry about health care costs. In their 2017 study, the group found that 51% of wealthy people worry about being financially secure in retirement.

So what can you do?

1) Start planning for long term care TODAY and 2) consider a combination of BOTH insurance and investments to offset risks.

As always, I recommend all my clients reach out to an investment pro for retirement and investment advice. That’s because retirement planning is highly personal, and there are few things more important than having enough to cover long term care. But to get you started, here are the seven key steps to take when beginning your long term care planning.

Seven Steps to Long Term Care Planning

1. Know your numbers

To create an accurate long term care plan, you first need to know how much your care will cost.

Cost of care today

According to the National Care Planning Council, the average person spends 835 days in nursing home care or a little under 2.5 years. At $102,204 per year, calculating long term care costs seems rather simple at first glance.

However, averages hide the real truth.

In the United States, over 40% of people never require long-term care. These people either stay independent through old age or have a sudden onset of disease or disability that nursing homes aren’t equipped to handle. On the other hand, about one in four people will develop long-term illnesses that can require lengthy long term care stays. For instance, people with Alzheimer’s can live for ten or more years and nursing home care, costing over $1.5 million for treatment.

Future cost of care

Medical inflation is another primary concern for people facing long term care.

Studies show that medical care costs continue to outpace inflation by 2-3 times. In 2018, the cost of nursing home care rose 4.11%. And even if healthcare costs moderate, a 3.5% annual increase still means a 55-year-old can expect to pay almost $300,000 per year by the time they reach age 85

How much will long term care cost for you?

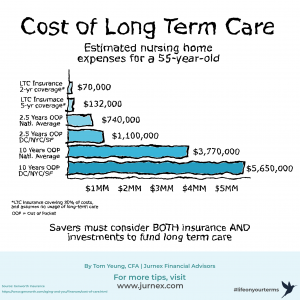

Depending on your age, location, and requirements, your dollar amount needed for long term care can range from $500,000 to $5 million or more. Much of this depends on your requirements: nursing homes vary widely in their quality of services, and you might need greater or fewer years of care.

But in general, I recommend budgeting in at least $110,000 per year (in today’s dollars) for long term care, anticipating 4-8 years of use, and calculated with a 3.5% inflation rate. That comes to about $1.2 to $2.8 million for the average 55-year-old in thirty years time.

Contact an expert help calculate your long term care needs

2. Know your risk factors

It’s essential to know your risk factors when assessing a long-term care plan. According to the National Center for Health Statistics, here are the most critical factors for your health:

- Smoking

- High blood pressure

- Elevated blood sugar

- Obesity

- Genetic risks

Also, certain diseases cost more than others to treat. Here are the top four:

- Alzheimer’s. According to the Alzheimer’s Association, cases can cost $2 million or more in nursing home care.

- Dementia. People living with dementia require $341,840 on average to treat.

- Cancer. Depending on the type of cancer, the cost of treatment can range from $50,000 to several million.

- Renal Diseases. Dialysis costs upwards of $90,000 per year

Of course, even the healthiest person today may require many years of long-term care. But if you already know you’re at a higher risk of needing long-term care, you should adjust your budget to cover those expectations.

Read more about single life retirement planning here

3. Pre-select your long term care provider

From an economic perspective, those who pre-select their long-term care provider have a distinct advantage of being able to plan for health care costs. That’s because nursing home fees vary widely.

For example, the average nursing home costs in Oklahoma comes to $60,225 per year. The same service will cost $152,000 on average in Washington, DC.

Even within the same state, nursing home costs vary widely. Private nursing homes with better amenities can easily cost $400,000 to sign up. After that, these communities can cost $250,000 or more per year in fees.

When pre-selecting your provider, consider the following:

- Cost of living

- Amenities and quality of care

- Proximity to friends and family

- Home-care options

Understanding your cost of long-term care requires some projections. Professional advisors typically use financial models and Monte Carlo analysis to create cost estimates. There are also free calculators you can use to get a sense of your future long term care costs.

Read more about surviving retirement without kids here

4. Create a savings plan

Once you have an idea of how much long term care planning costs, you have to figure out how to reach the goal. And this involves calculating how much you need to save.

Here is where a professional investment advisor can help. That’s because there are many moving parts to savings plans: investments can grow over time, and savings rates will change throughout your life. To get you started, here are some considerations.

- Age. Compound interest means money saved early on makes a greater impact on funding long term care. Older people need to save more.

- Life situation. The ability to save will change with children, tuition, house, and jobs. People in their late-50’s can usually save more money than those in their 40’s with children going through college.

- Risk tolerance. Savers who are willing to consistently invest generally see their investments grow faster than those who stay on the sidelines

Establish a baseline savings rate

Regardless of your life situation, I typically recommend people save at LEAST 15% of their income to fund retirement, and another 5% to cover long term care and other medical costs. These numbers can vary depending on your situation, however, and calculating the exact amounts requires some math and financial software. While there are some free online tools, I generally recommend you reach out to an investment professional to get an accurate number.

5. Invest for growth

Once you are saving enough for your long term care plan, you need to have your investment start working for you. That’s because your investments must keep up with the rising costs of medical care.

In other words, it’s not enough to have your savings sit in fixed deposits. To afford future health care needs, you need to invest for growth, and not just for wealth preservation.

- Stocks. One of the best ways to invest for growth is to buy-and-hold high-quality, high-growth companies. Read how to invest in stocks

- Real Estate. Rental properties can provide a stream of cash flow that you can reinvest for even more future growth. Read about investing in real estate

- Health Savings Accounts. Some HSA providers offer mutual funds and ETFs that allow you to invest in stocks and bonds.

- Investments in medical-related companies. Savvy investors can look to buying high-quality healthcare and insurance providers to reduce their risks. The faster medical expenses go up, the quicker the investments in health care companies can grow too.

It’s essential to choose investments that align with your long term care plan. You need to strike a balance between investments that will grow fast enough to outpace medical costs and investments that will maintain their value in market downturns.

6. Reduce risk with partial long term care insurance

For anyone worried about the cost of long term care, I usually recommend they buy a small amount of long-term care insurance to reduce risk.

In other words, you should buy an insurance policy that covers 30-60% of long-term care costs. Premiums for people in their mid-50’s typically range from $800 to $1,900 per individual, with the average at around $1,138 for men and $1,631 for women for 30% coverage lasting two years.

Why not insure 100% of medical costs?

In general, insuring long term care at a full 100% is prohibitively expensive. Insurance companies incentivize users to avoid unnecessary use of nursing home care.

That’s why it usually makes sense to take out a cheaper policy that covers just 30-60% of long term care needs. That way, you’re still reducing the amount you have to pay if something catastrophic happens while avoiding over-paying for insurance.

Also, the extra cash can be saved and invested. That way, if it turns out you don’t need ten years of long-term care, you’ll have the money to spend elsewhere or leave an inheritance to your children. Premiums to unused long-term care insurance typically have zero cash value.

7. Start today

It can be tempting to put off long term care planning. After all, the number of unknowns can bewilder even the best-intentioned planner.

But don’t let that stop you from getting started.

That’s because the earlier you start, the easier it is to fund your long term care needs. And with the right plan in place, you can stop worring and start living instead. Because isn’t that the whole point of life?

Where to find more resources

If this seems like a lot of information, don’t worry. The great news is that help is available. That’s because here at Jurnex, we work with individuals and families just like you to make the most out of investing. I’ve helped invest client money for over a decade in the same old-fashioned way. And that’s to seek out great companies in great industries that can you can buy at a discount to their fair value. Sounds too simple to be true? Give me a call today, and I’ll show you that it’s still possible after all these years.

About Jurnex

We are an independent registered investment advisor and asset manager. We have the securities backing of Charles Schwab, yet we retain our operational independence from any third party. This means you can have the confidence your money is safe with one of America’s best brokerages and still receive knowledge and advice from an independent firm focused on YOU.

Want to learn more?

Book an Initial Meeting