How much do you need to save for retirement?

5 Tips from an LGBT Financial Advisor

While saving for retirement is hardly sexual-orientation specific, as an LGBT individual or family, it can be difficult to know how much to save. The needs of LGBT people can be very different from others.

There are a lot of resources for heterosexual couples. But what about LGBT people? The issues of dual incomes, adoption, and alternative lifestyles are common themes. Yet these are issues seldom covered by most retirements specialists.

So where to start?

If you want to know how much you should save for retirement as an LGBT person, this article is for you. In this article, we cover the five key tips to help you figure out how much you need to save for retirement. We’ll also cover whether an LGBT Financial Advisor for retirement planning is right for you. By the end of this article, you should have a good idea of how much to save for retirement.

Tip #1: Know where you will retire

It costs 78% more to live in New York City than in Chicago

Living costs vary widely across the US. For example, a family looking to retire in New York City will need to save almost twice as much as the average US family.

But here is where LGBT people are different: we tend to have increased mobility in retirement.

My experience as an LGBT Financial Advisor is that LGBT people are more than twice as likely move for retirement.

There are several reasons for this:

- Smaller family sizes

- Greater prevalence of dual-incomes

- Better retirement options (i.e. Ft Lauderdale, Palm Springs)

Also, the majority of LGBT professionals work in cities with higher costs of living. Once they retire, LGBT people often find themselves less willing to pay high prices for a convenience they no longer need.

Moving doesn’t mean you have to give up on a fabulous lifestyle. It just means you can have more of it! Cost-of-living in Fort Lauderdale is almost half of NYC/SF.

What if you don’t know where you’ll retire yet?

That’s fine too. You don’t need to know exactly where you retire.

But you should have an idea of whether you would rather stay where you are, or move to a different location.

The table below outlines roughly how much you need for a comfortable retirement in each state. This assumes some Social Security payments as well.

The top-10 most expensive states to retire

| 1 | Hawaii | $1,883,600 |

|---|---|---|

| 2 | Washington DC | $1,614,000 |

| 3 | California | $1,374,300 |

| 4 | New York | $1,344,600 |

| 5 | Massachusetts | $1,325,700 |

| 6 | Maryland | $1,301,000 |

| 7 | Oregon | $1,300,000 |

| 8 | Alaska | $1,276,200 |

| 9 | Connecticut | $1,213,800 |

| 10 | Rhode Island | $1,213,600 |

The top-5 least expensive states to retire

| 1 | Mississippi | $849,100 |

|---|---|---|

| 2 | Oklahoma | $872,900 |

| 3 | Arkansas | $875,800 |

| 4 | Missouri | $879,900 |

| 5 | Michigan | $884,800 |

*figures were taken from a GoBankingRates study and updated for estimated cost-of-living

Tip #2: Know your health risk factors.

Besides living expenses, medical costs are the next largest expense for retirees.

What you’re looking for are chronic illnesses. These can be either genetic or environmental. But what’s the one thing chronic illnesses have in common? They are expensive to live with.

Most financial advisors recommend people have at least $1 million in savings (in today’s money) by the time they retire. For 80% of cases, $1 million is a comfortable amount. However, no one is truly average.

Riddle: there was once a 6-foot man who drowned crossing a river that was 5-feet deep on average… how did that happen?

*he drowned in the deep end

While a single trip to the ER might cost tens of thousands of dollars, someone who develops Alzheimer’s can spend an additional $500,000 over the course of just 8 years.

The CDC recognizes that LGBT men and women have different public health needs. It’s important you consider these health issues too.

Some chronic diseases to look for

Alzheimer’s: $500,000

According to Paying For Senior Care, the cost or Alzheimer’s assisted living residence cost $3,600/month. Nursing homes increase the cost to $6,600/month.

Little is understood on how to treat Alzheimer’s. But we do know there is a genetic component. Check whether the any of your family members have Alzheimer’s. For those that do, make sure you save more.

Cancer: $50,000 – $200,000

While Medicare will pay for the majority of cancer treatment, out-of-pocket costs can still be quite high. For people with family histories of cancer, make sure you understand how much treatments can cost, and make sure you get the correct screenings and preventative care.

HIV/AIDS: $100,000 – $250,000

While healthcare costs for HIV treatment have decreased in recent years, treating complications remains expensive. The NIH estimates lifetime costs of treatment at $326,500, while the CDC estimates at $400,000.

Many of these expenses come towards end-of-life during complications

Tip #3: Know the financial arrangement between you and your partner

Married or domestic partners? Open relationship or single?

If you are married or in a long-term relationship, make sure you understand whether your partner will help support you in retirement. Having two incomes will help spread the risk of running out of money in old age.

Where a single person may need $2 million to comfortably retire, two people might need just $3 million.

Why do couples need less in retirement?

- The ability to share risk: if one partner falls ill with a chronic illness, the savings of the other partner can help cover expenses.

- Shared expenses: paying for two can save money. Retired couples can share major expenses such as housing, insurance, and vehicles.

- Shared Social Security benefits: same-sex married spouses can now claim Social Security benefits on their spouse’s work record.

Make sure the financial arrangement is clear between you and your partner. As an LGBT financial advisor, I’ve found that LGBT families are far more likely than same-sex couples to have separate finances.

What if you’re single?

As a single LGBT individual, you have additional flexibility in your lifestyle choices. But it also comes with a greater degree of financial responsibility. Being self-reliant means you generally have to save more and have a higher amount of disability insurance. The additional insurance can help cover shortfalls in case you can’t work until retirement.

Whether you’re single or coupled, a good plan is key to having a great retirement.

Tip #4: Check your access to retirement and insurance benefits

Do you have spousal benefits?

When calculating how much to save for retirement, you should know whether you are eligible for your partner’s retirement.

Legally married spouses

Because same-sex marriage is now federal law, same-sex couples now receive the same benefits as heterosexual couples.

Most companies offer some form of spousal benefits. This can mean tens of thousands of dollars in savings from accessing your spouse’s health care insurance and retirement benefits.

Healthcare: In 2017, the average employee contributed $3,531 for a couples plan for the year (or $1,766 per person) according to the Kaiser Family Foundation. The average cost for a single person on the ACA healthcare exchange? $4,536. That’s an immediate savings of $2,770/year.

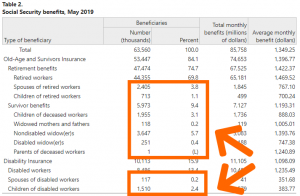

Retirement: As of 2019, 17% of Social Security was paid to dependents, amounting to $14.5 billion per month.

A significant portion of social security is given to spouses of retired workers. Make sure you understand how much you’re eligible for.

Domestic partners

This is where LGBT finance becomes trickier. Some companies such as FedEx and Walmart allow domestic partners to participate in health insurance and spousal retirement benefits.

Yet many employers, including the federal government, don’t recognize these same domestic partnerships. Be proactive in figuring out what benefits you’re eligible for. That’s because it matters. The greater the benefits you receive, the more you will have for retirement.

Tip #5: Put it all together

Now it’s time to do the math.

For a rough estimate on how much you need to save, follow these four steps from above

1. Decide what state you will retire in.

Check the table above to find how much it might cost to retire in your state. If it’s not listed, or you don’t know, use $1 million to start.

Example: “I’d like to retire in DC: $1,200,000 required”

2. Assess your risk factors

If your family has a history of chronic illnesses, add $100-$500K depending on the severity and length of the disease. If you’re not sure, then put in $400K and move on.

Example: “I want to be conservative: $400,000”

3. Add in your spouse if applicable

If you share finances with a committed partner, you can add 50% to the total amount needed for savings (rather than doubling the amount). So $2 million will turn into $3 million.

Example: “We’re in a long-term relationship, but unsure about financial ties. (no change)”

4. Add in spousal benefits

Spousal programs can add tens of thousands of dollars in retirement per year. Make sure you understand your eligibility and calculate its present value. For example, a stream of inflation-protected $50,000 payments over 20 years might be worth $1 million today (if you ignore discounting, a financial term)

Example: “We’re domestic partners, and don’t have access to spousal retirement benefits (no change)”

5. Use a financial calculator to determine how much you need to save

Below, I’ve provided a simple calculator to determine how much you need to save for retirement.

Example: $1,200,000 + $400,000 = $1,600,000. At age 45 with $450,000 already saved, will need to save around 12% of income or $10,000 per month

Retirement Calculator

You will have: $1,600,000.00 at retirement

You will need to save: $1,000 per month

Please note this is simply an estimate for how much you might need to save. If you need a more accurate estimate or have a special case (such as adoption, special health issues or owning a business), you might benefit greatly from directly contacting an LGBT Financial Advisor for retirement planning.

Don't be dissuaded by cost. Personal financial advice is actually quite affordable, and the right advisor will pay for themselves at least ten times over.

Conclusion

Bringing it all together

Even though retirement may seem far, far away, saving for retirement is actually something you can do today. It only takes small contributions on a regular basis, and you can reap rewards for decades to come.

As an LGBT individual or family, you also have a greater choice in how to save for retirement. The ability to move, coupled with the freedom to share finances, means greater flexibility and opportunity for a higher-quality retirement.

However, having the right advisor can also help greatly. LGBT specific issues, such as domestic partnerships and healthcare costs can easily blindside even the most prepared of savers.

If you want to see whether an LGBT Financial Advisor for retirement planning is right for you, contact us today. We do FREE consultations because we know the importance of helping you find the right fit.

How can we help?

If you’re looking for advice about your own finances, you can contact us for more information. We at Jurnex Financial Advisors are asset managers who specialize in helping families and individuals navigate major life changes. If you want to get started in regaining confidence over your wealth, book a meeting with us today and see how we can help.

If you want to learn more about LGBT financial advisory, you can also check out our Ultimate Guide to LGBT Financial Advisory.